Stop & Shop: A Look at the Northeast’s Historic Grocery Retailer

Stop & Shop grocery store entrance. Image credit: Mike Mozart via Flickr, CC BY 2.0

Stop & Shop stands as one of the Northeast’s most enduring grocery retailers, with a history spanning over 130 years and approximately 400 stores across Massachusetts, Connecticut, Rhode Island, and New York. As a wholly owned subsidiary of international food retail group Ahold Delhaize, Stop & Shop combines its deep regional roots with global retail expertise. Despite facing intense competition and undergoing significant strategic changes, including the recent closure of 32 underperforming stores, the chain remains a dominant presence in several Northeastern states and continues to evolve its operations to meet changing consumer demands in an increasingly competitive grocery landscape.

Historical Background

Founding and Early Years

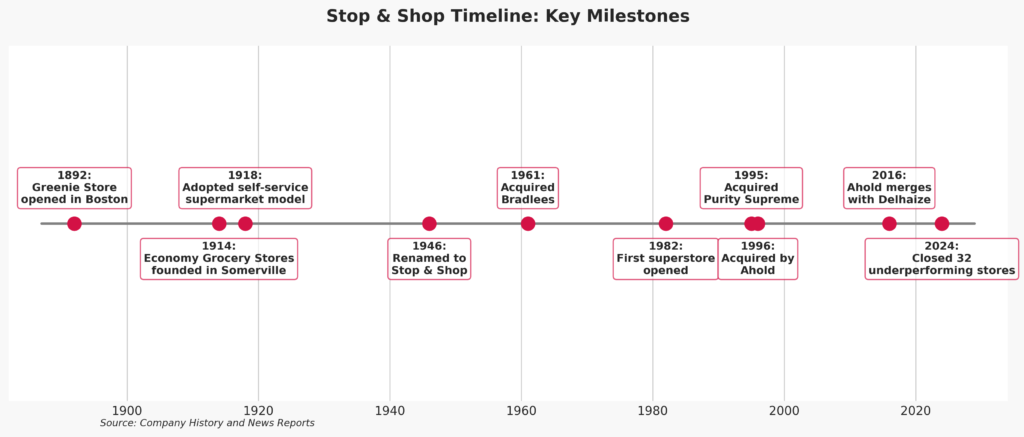

Stop & Shop’s story began in 1892 when Solomon and Jeanie Rabinowitz opened a small grocery shop called the Greenie Store at 134 Salem Street in Boston’s North End. The business was officially established as Economy Grocery Stores Company in 1914 in Somerville, Massachusetts by the Rabinowitz family. The company was quick to embrace innovation, adopting the self-service supermarket model pioneered by Piggly Wiggly in 1918, a revolutionary concept at the time that would transform grocery shopping. The second store opened later in 1914, and by 1917, the chain had grown to 15 stores. Initially selling only grocery items, the stores soon expanded their offerings to include meats, produce, milk, dairy, and frozen foods, providing a more comprehensive shopping experience for customers.

Key Expansion Milestones

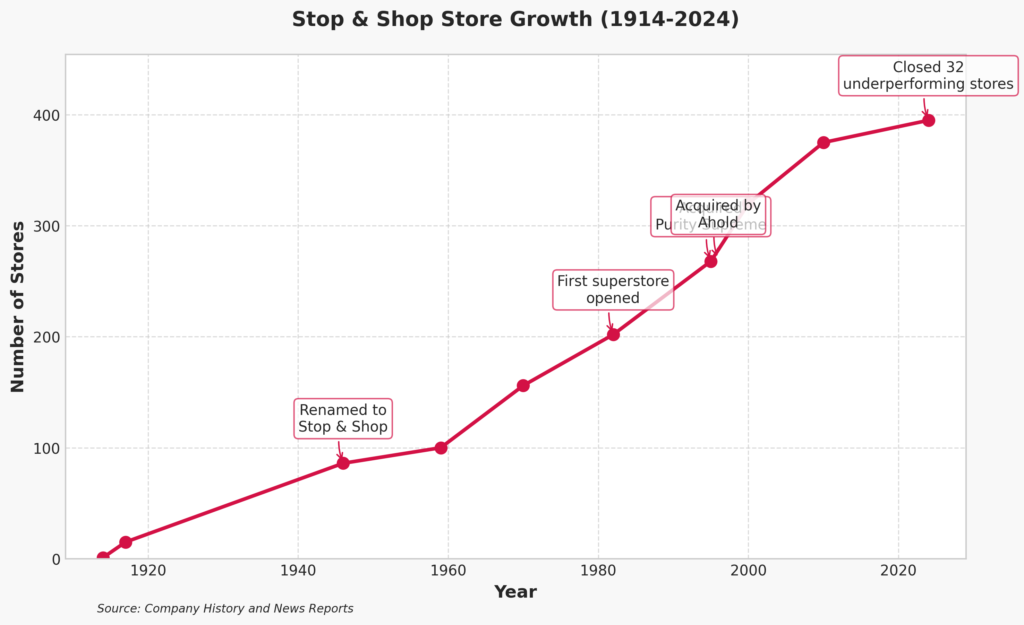

The company experienced steady growth throughout the mid-20th century. By 1946, the chain had expanded to 86 supermarkets and officially changed its name from Economy Grocery Stores to Stop & Shop, Inc., establishing the brand identity that continues today. The company reached a significant milestone in 1959 when it opened its 100th store in Natick, Massachusetts. Geographic expansion began in earnest during the 1950s, with Stop & Shop entering the Connecticut and Rhode Island markets, followed by New York in the early 1960s and New Jersey in the late 1960s. The 1980s marked another pivotal development when Stop & Shop built its first superstore in Pembroke, Massachusetts in 1982, pioneering the superstore concept on the East coast. This period also saw some strategic market exits, including the sale of profitable New Jersey stores to A&P and some New York locations to A&P and Grand Union in 1982. Throughout the 1980s and 1990s, the company focused on converting traditional supermarkets to larger superstores ranging from 45,000 to 80,000 square feet.

Stop & Shop Timeline: Key Milestones from 1892 to 2024

Acquisitions and Mergers

Stop & Shop’s corporate history includes numerous acquisitions and mergers that shaped its development. In 1961, the company acquired department store chain Bradlees, expanding beyond grocery retail. During the 1960s, Stop & Shop acquired the three-store chain ORBIT’S and merged them into Bradlees. The company also operated Medi-Mart pharmacy chain and Perkins Tobacco chain, diversifying its retail portfolio. In early 1985, Stop & Shop acquired small discount store chain Almy’s, though this venture was short-lived, with Almy’s closing in 1987. The late 1980s brought significant change when leveraged buyout specialists KKR acquired Stop & Shop following a hostile takeover bid. This period saw the company divest several operations, with Medi-Mart being sold to Walgreens and Bradlees spun off as a separate corporation. In 1995, Stop & Shop strengthened its grocery operations by acquiring competitor Purity Supreme supermarkets. The most transformative change came in 1996 when Dutch retail conglomerate Ahold USA acquired Stop & Shop, bringing the chain under international ownership. This international connection was further solidified when Ahold merged with Delhaize Group on July 24, 2016, forming Ahold Delhaize, Stop & Shop’s current parent company.

Notable Challenges or Controversies

Throughout its long history, Stop & Shop has faced various challenges and controversies. The company has weathered economic downturns, changing consumer preferences, and intense market competition. More recently, Stop & Shop has faced significant challenges in maintaining its competitive edge in the Northeast grocery market. In 2024, the company made the difficult decision to close 32 underperforming stores, signaling a strategic pivot to focus resources on more profitable locations. Industry analysts have noted that Stop & Shop has struggled with maintaining its distinctive local identity in the face of competition from both regional players with strong local connections and national chains with distinctive brand positioning. The reduction of high-paying union jobs in specialty departments like butchery and seafood has been a contentious strategy, balancing cost efficiency against service quality. These challenges reflect the broader difficulties facing traditional supermarket chains in an era of changing consumer expectations and increasing competition from specialized grocers, discount chains, and online retailers.

Stop & Shop Store Growth (1914-2024) showing key milestones and expansion

Current Operations

Geographic Footprint

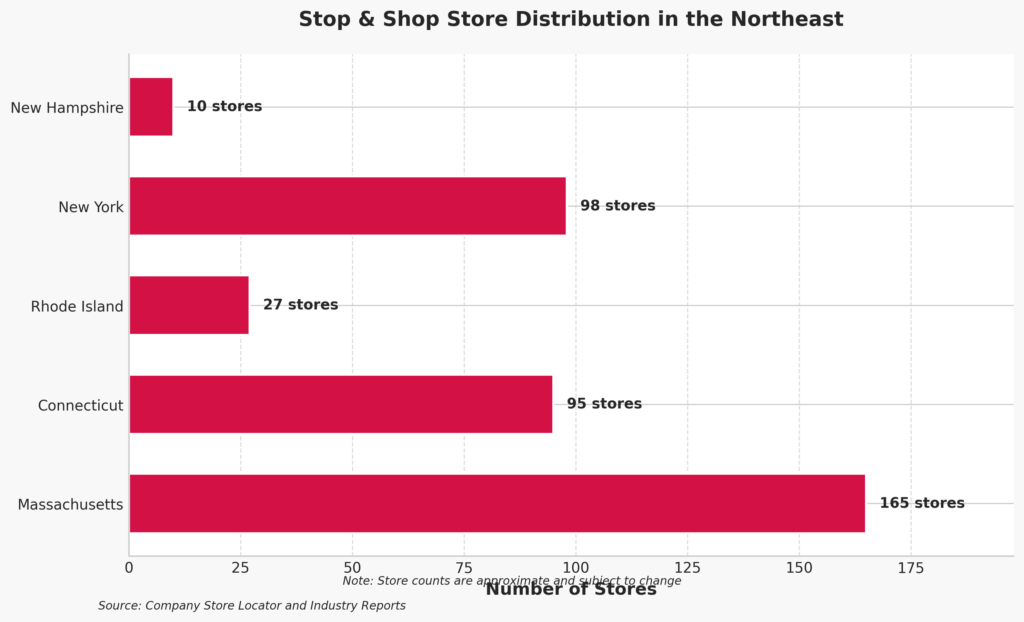

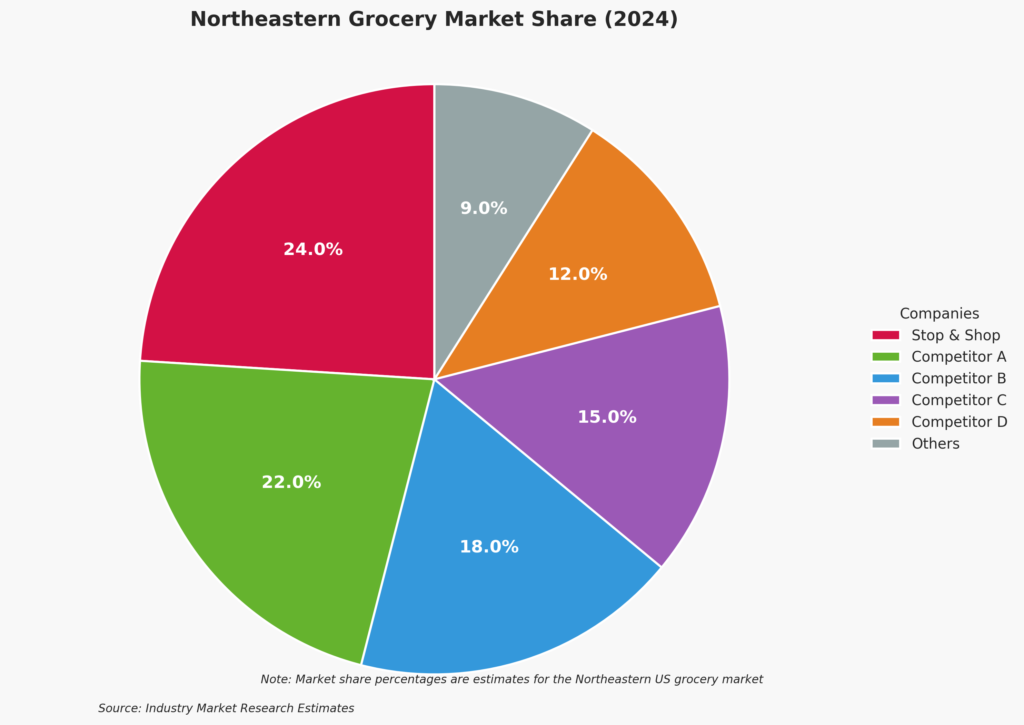

Stop & Shop currently operates approximately 395-406 stores (numbers vary by source) across the northeastern United States. The chain has a significant presence in Massachusetts, Connecticut, Rhode Island, and New York, with its corporate headquarters located in Quincy, Massachusetts. The company’s geographic distribution is strongest in southern New England, where it maintains dominant market positions in Rhode Island and Connecticut. According to Placer.ai data from the first half of 2024, Stop & Shop had the largest share of visits among grocery chains in these states, though its lead is narrower in Massachusetts and New York. In Massachusetts, Stop & Shop leads Market Basket by only 3 percentage points in visit share, while in New York, it’s just 1 percentage point ahead of Wegmans. In New Jersey, where the company once had a stronger presence, Stop & Shop now ranks as the third grocer by visit share (10%) behind Acme Markets (10%) and ShopRite (46%). The recent closure of 32 underperforming stores has somewhat reduced the chain’s geographic footprint, but the company remains focused on strengthening its position in core markets.

Stop & Shop Store Distribution across Northeastern states (2024)

Store Formats and Concepts

Stop & Shop pioneered the superstore concept on the East coast, and its stores typically feature a comprehensive range of departments and services. Standard Stop & Shop locations include bakeries, pharmacies, and expanded deli departments, with some locations also featuring banks, expanded liquor and beer sections, and other specialty services. The company has been actively remodeling its stores to enhance the customer experience, with approximately half of its locations having undergone renovation since the current remodeling initiative began in 2018. These renovated stores showcase the company’s updated approach to grocery retail, with expanded fresh departments and improved layouts. A prime example of Stop & Shop’s evolving store concept is the newly built store that opened in Boston’s Allston Yards development in June 2024. This location features an expanded produce department with a greater variety of local foods, a large prepared foods department with a full hot bar, and enhanced multicultural offerings with more than 800 multicultural items. This store represents the company’s effort to create formats that better serve diverse and changing neighborhoods while maintaining the core Stop & Shop shopping experience.

Corporate Structure and Philosophy

Stop & Shop operates as The Stop & Shop Supermarket Company, LLC, a wholly owned subsidiary of Ahold Delhaize since 1995. As part of the Ahold Delhaize family, Stop & Shop is a sister company to other U.S. grocery chains including Hannaford and Food Lion. This corporate structure provides Stop & Shop with the resources and scale advantages of being part of a global retail organization while allowing for regional market adaptation. The company’s current strategic philosophy focuses on creating value for customers through price investments, enhanced fresh offerings, and improved store experiences. Stop & Shop is working to strengthen its connections with local communities and producers, recognizing that a return to more localized assortments and stronger regional relationships may be key to differentiating itself in a competitive market. The company has also embraced a commitment to sustainability and community involvement, as evidenced by the publication of its first Corporate Social Responsibility Report in 2024, which highlights initiatives like the “Feed It Forward” program promoting healthy living and partnerships with regional food banks and local hunger-relief agencies.

Northeastern Grocery Market Share comparison showing Stop & Shop’s position (2024)

Financial Performance

Revenue and Growth

As a subsidiary of Ahold Delhaize, Stop & Shop’s specific financial performance is not reported separately in public financial statements. However, the parent company Ahold Delhaize reported €89.4 billion in net sales for the full year 2024, with its U.S. operations contributing €54.2 billion, representing a slight decline of just under 1% year-over-year. For the fourth quarter of 2024, Ahold Delhaize’s U.S. sales came in at 13.9 billion euros ($14.4 billion) at constant exchange rates, representing a decline of 0.6%. However, these figures reflect the performance of all Ahold Delhaize’s U.S. banners, not just Stop & Shop. The company has noted that excluding the impacts from the divestment of FreshDirect, the closure of Stop & Shop stores, and the cessation of tobacco sales in the Netherlands, net sales growth would have been 2.1 percentage points higher. This suggests that the Stop & Shop store closures had a significant impact on overall sales figures. Looking ahead, Ahold Delhaize expects the Stop & Shop closures to cost the company between $550 million and $575 million in sales in 2025, according to statements by CEO Frans Muller.

Store Performance Metrics

Despite the challenges reflected in overall sales figures, there are some positive performance indicators for Stop & Shop. In the fourth quarter of 2024, comparable sales excluding gasoline increased by 1.4% in the U.S., indicating that existing stores are showing growth. Stop & Shop specifically has recorded “positive effects” from its efforts to lower prices and build its private label offerings, according to CEO Frans Muller. The company has seen indications in the early weeks of 2025 that its price investments are making a difference in store performance. The remodeling program that began in 2018 has reportedly helped boost sales in renovated stores, though industry analysts caution that renovation-driven sales improvements can sometimes mask underlying issues. Operating income for Ahold Delhaize’s U.S. operations surged by over 30% in Q4 2024, to 568 million euros, and was up by more than 8% for the full year, to 2.2 billion euros. This suggests that despite sales challenges, profitability has improved, potentially reflecting the benefits of closing underperforming locations and focusing on operational efficiency.

Employment and Economic Impact

Stop & Shop remains a significant employer in the Northeast, though specific current employment figures are not readily available. The company provides a range of jobs across its approximately 400 stores, distribution centers, and corporate offices. As a unionized workplace, Stop & Shop offers competitive wages and benefits to many of its employees. However, industry analysts have noted that the company has reduced high-paying union jobs in specialty departments like butchery and seafood in recent years, a move that has been contentious. Beyond direct employment, Stop & Shop has a substantial economic impact on the communities where it operates. The company works with local and regional suppliers, supporting the broader food production and distribution ecosystem in the Northeast. The recent store closures have had mixed economic impacts, with job losses in affected communities but potentially stronger long-term prospects for the company and its remaining workforce. Stop & Shop’s community initiatives, including partnerships with food banks and hunger-relief agencies, also contribute to its economic and social impact in the region.

Work Environment and Culture

Employee Benefits and Programs

Stop & Shop offers a comprehensive benefits package to its employees, reflecting its position as a major employer with significant union representation. The company provides health insurance, competitive wages, paid vacation and holidays, and employee discounts. Additional benefits include a flexible work environment, tuition reimbursement of up to $5,250 per year for work-related degrees, and on-site gym facilities at some locations. The company offers flexible hours and shifts, which is particularly valuable for part-time employees and those balancing work with other responsibilities. Many positions at Stop & Shop are represented by unions, which helps ensure standardized wages and working conditions. The company’s Sunday pay differential is noted as a positive aspect of employment, providing enhanced compensation for weekend work. These benefits help Stop & Shop attract and retain employees in the competitive retail labor market, though the company, like many in the grocery sector, continues to adapt its employment practices to balance labor costs with competitive compensation.

Corporate Culture

Employee reviews of Stop & Shop’s workplace culture are mixed, with both positive and negative aspects highlighted. On the positive side, the flexible scheduling, good part-time benefits, union wages, and Sunday pay differential are frequently mentioned as advantages of working at Stop & Shop. The environment is generally described as low-stress compared to some retail settings. However, some employees note challenges, including limited wage differentiation due to the union structure, which can affect advancement opportunities. As part of Ahold Delhaize, Stop & Shop operates within a larger corporate culture that emphasizes customer service, operational excellence, and community engagement. The company’s recent publication of its first Corporate Social Responsibility Report indicates an increasing focus on articulating and strengthening its corporate values and social impact. This may reflect efforts to enhance the company’s culture and employee engagement as part of its broader strategic repositioning in the market.

Training and Development

While specific details about Stop & Shop’s current training and development programs are limited in the available research, the company does offer tuition reimbursement of up to $5,250 per year for work-related degrees, indicating a commitment to employee education and advancement. As part of Ahold Delhaize, Stop & Shop likely benefits from the parent company’s training resources and best practices. The grocery industry generally requires specific training for various departments, particularly in areas like food safety, pharmacy operations, and customer service. Stop & Shop’s training programs would need to address these operational requirements while also developing the skills needed for its evolving store concepts and service offerings. The company’s ability to effectively train and develop employees will be an important factor in its efforts to enhance customer experience and differentiate itself from competitors through service quality.

Merchandising Strategy

Product Selection Philosophy

Stop & Shop operates as a full-service grocery retailer with a wide product selection designed to meet the diverse needs of its customer base. The company has historically focused on providing quality and variety across departments, though industry analysts have recently characterized its offering as somewhat “vanilla” or “non-differentiated” compared to competitors with more distinctive merchandising approaches. Stop & Shop has demonstrated a commitment to transparency in its product selection, including transparent GMO labeling. Recent strategic shifts suggest the company is working to enhance its product selection philosophy, with a greater emphasis on local and regional products. The newly renovated store in Boston’s Allston Yards, for example, features an expanded produce department with a greater variety of local foods and more than 800 multicultural items, indicating efforts to better serve diverse communities with more culturally relevant assortments. Industry experts have suggested that strengthening relationships with regional producers and expanding assortments of fresh foods could help Stop & Shop differentiate itself in the competitive Northeast grocery market.

Private Label Brands

Private label development has become an increasingly important part of Stop & Shop’s merchandising strategy. The company offers a “Family of Brands” consisting of exclusive products throughout the store. The premium private label line, Stop & Shop Select, includes a variety of products such as carbonated beverages, diet sparkling water products, pet foods, crackers, salad dressing, and pasta sauce. The company also offers a premium private label coffee line with seven blends available in ground coffee or K-Cups. Stop & Shop has announced plans to remove artificial ingredients from its private label products, including artificial sweeteners, high fructose corn syrup, synthetic colors, MSG, artificial flavors, and preservatives, reflecting consumer demand for cleaner ingredient lists. According to Ahold Delhaize CEO Frans Muller, Stop & Shop’s private label sales have been outpacing sales of other goods in terms of both dollars and units sold, indicating success in this area. The company’s continued focus on building awareness of its own brands is part of its broader strategy to differentiate itself and improve margins. Ahold Delhaize has set a goal for private label to become 45% of total store sales, suggesting further expansion of these offerings is planned.

Specialty Departments

Stop & Shop stores typically feature a range of specialty departments, including bakeries, pharmacies, and expanded deli sections. Some locations also include banks, expanded liquor and beer sections, and other specialty services. However, industry analysts have noted that Stop & Shop’s specialty departments may not be as distinctive or compelling as those of some competitors. According to retail intelligence provider RetailStat, Stop & Shop “doesn’t have a very exciting bakery department” and its meat department is not “out-of-the-ordinary,” suggesting opportunities for improvement in these areas. The company appears to be addressing these concerns in its remodeled stores, with enhanced fresh departments and improved layouts. The new Allston Yards store in Boston, for example, features a large prepared foods department with a full hot bar, indicating efforts to strengthen the appeal of specialty offerings. As Stop & Shop continues its strategic repositioning, enhancing the distinctiveness and quality of its specialty departments could be an important factor in differentiating the chain from competitors and creating more compelling reasons for customers to choose its stores.

Marketing and Customer Experience

Loyalty Programs

Stop & Shop operates the GO Rewards loyalty program, which offers customers various benefits and savings opportunities. Through this program, customers earn 1 GO Point per dollar spent on groceries, which can then be redeemed for grocery and gas savings. The program also provides digital deals on favorite items, enhancing the value proposition for regular shoppers. The GO Rewards program is integrated with Stop & Shop’s online shopping experience, creating a seamless connection between in-store and digital interactions. This integration is increasingly important as more customers adopt omnichannel shopping behaviors. While specific participation rates for the GO Rewards program are not available in the research, loyalty programs are a standard feature in the grocery industry and an important tool for gathering customer data, personalizing offers, and encouraging repeat visits. As Stop & Shop works to strengthen its competitive position, effectively leveraging its loyalty program to deepen customer relationships and drive targeted marketing will be an important strategic consideration.

Digital and Omnichannel Initiatives

Stop & Shop has been actively developing its digital and omnichannel capabilities to meet evolving customer expectations. The company offers online grocery delivery and pickup services, supported by a mobile app for shopping and managing rewards. In 2020, Stop & Shop launched a new e-commerce platform, enhancing its digital shopping experience. The company’s delivery service is available through partnerships with third-party providers like DoorDash, expanding its fulfillment options. Previously, Stop & Shop’s online grocery service operated under the Peapod brand, but these operations have now been integrated under the Stop & Shop banner, creating a more unified brand experience. To encourage adoption of its online services, Stop & Shop has offered special promotions for first-time online shoppers, such as $25 off first two delivery/pickup orders of $100 or more. According to Ahold Delhaize’s financial reports, online sales in the U.S. were down year-over-year by just under 1% during Q4 2024, primarily due to the sale of FreshDirect. However, excluding the impact of the FreshDirect divestiture, U.S. digital sales would have been up by 10.9%, indicating growth in the core online grocery business. Customers are reportedly responding positively to the partnership with DoorDash, with orders accelerating a further 20% compared to Q3 2024.

Additional Services

Beyond its core grocery offerings, Stop & Shop provides various additional services to enhance the customer experience and drive store traffic. Many locations include pharmacy services, offering prescription fulfillment and health-related products. Some Stop & Shop stores also feature gas stations, providing fuel savings opportunities that integrate with the GO Rewards loyalty program. The company operates an affiliate program for website promotions, creating additional marketing channels and partnership opportunities. These supplementary services help position Stop & Shop as a convenient one-stop destination for multiple shopping needs, potentially increasing visit frequency and basket size. As the company continues to refine its strategy and store formats, the mix and presentation of additional services may evolve to better align with customer preferences and competitive positioning in different markets.

Community Involvement

Stop & Shop has demonstrated a commitment to community engagement through various initiatives and partnerships. In 2024, the company published its first-ever Corporate Social Responsibility Report, highlighting its “Feed It Forward” initiative focused on promoting healthy living and addressing food insecurity. The company works with regional food banks, local hunger-relief agencies, and schools to build sustainable solutions for providing greater access to nutritious food. One specific program is the Stop & Shop School Food Pantry Program, which fights student hunger through in-store fundraising campaigns. In 2024, the company ran a register campaign from August 2 through September 1, allowing shoppers to donate by rounding up their purchase to the nearest dollar. Stop & Shop also organizes Community Health and Wellness Fairs featuring locally based businesses and organizations covering various health and wellness categories. The company’s reusable community bag program supports local organizations, with initiatives like the April 2025 program benefiting RISE Rockaway. These community involvement efforts help strengthen Stop & Shop’s local connections and brand reputation while addressing important social needs in the communities it serves.

Future Outlook

Expansion Plans

Despite recent store closures, Stop & Shop and its parent company Ahold Delhaize have indicated plans for continued investment and targeted expansion. According to CEO Frans Muller, Ahold Delhaize plans to open 12 new supermarkets across its U.S. banners in 2025, though specific numbers for Stop & Shop were not detailed. The company is also continuing its store remodeling program, which has reached approximately half of Stop & Shop locations since beginning in 2018. The newly built store in Boston’s Allston Yards development, which opened in June 2024, represents the type of location and format that may guide future development, with its emphasis on fresh departments, prepared foods, and multicultural offerings. For 2025, Ahold Delhaize has stated it will “invest at a steady pace to enrich our omnichannel capabilities, drive growth in customer loyalty and expand our reach.” The company plans to “prioritize and add to the scope of price investments, accelerate new store openings and remodels, and scale technologies that have a proven and successful track record.” This suggests a measured approach to expansion, focusing on quality over quantity and ensuring new and remodeled stores align with evolving consumer preferences and market opportunities.

Competitive Positioning

Stop & Shop faces significant challenges in defining and strengthening its competitive positioning in the Northeast grocery market. Industry analysts have noted that the chain lacks a distinctive value proposition, with John Clear of Alvarez & Marsal observing, “They’re not known for price, they’re not known for some crazy indoor experience [and] also not known for being local and regional. The question is, what are they standing for?” To address this challenge, Stop & Shop appears to be pursuing several strategies. Price investments are a key focus, with the company working to improve its value perception among consumers. Building private label offerings is another priority, with these products outpacing national brands in both dollar and unit sales. Strengthening connections with local communities and producers may help restore some of the “local flavor” that analysts like Burt Flickinger III of Strategic Resource Group believe the chain has lost. The company is also working to enhance its fresh departments and specialty offerings, areas where competitors like Wegmans and Stew Leonard’s have established strong reputations. As consumer preferences continue to evolve and competition intensifies from both traditional supermarkets and alternative formats, Stop & Shop’s ability to establish a clearer and more compelling market position will be crucial to its long-term success.

Innovation Initiatives

Stop & Shop and its parent company Ahold Delhaize are investing in various innovation initiatives to enhance the shopping experience and operational efficiency. Digital and omnichannel capabilities remain a priority, with continued development of online shopping, mobile app functionality, and integration between digital and in-store experiences. The partnership with DoorDash for delivery services represents one aspect of this digital strategy, with orders reportedly accelerating in recent quarters. Store format innovation is evident in locations like the new Allston Yards store, which features enhanced departments and offerings designed to better serve diverse communities. Ahold Delhaize has indicated plans to “scale technologies that have a proven and successful track record,” suggesting a pragmatic approach to innovation that focuses on solutions with demonstrated benefits rather than experimental concepts. Private label innovation is another area of focus, with efforts to remove artificial ingredients from these products and develop distinctive offerings that can help differentiate Stop & Shop from competitors. As the grocery industry continues to evolve, Stop & Shop’s ability to identify and implement meaningful innovations that enhance customer experience and operational performance will be an important factor in its competitive positioning and long-term prospects.

Final Thoughts

Stop & Shop’s journey from a single Boston grocery store in 1892 to one of the Northeast’s largest supermarket chains reflects both remarkable resilience and the ongoing challenges of retail evolution. Today, the company stands at a critical juncture, working to redefine its identity and value proposition in an increasingly competitive grocery landscape. The recent closure of 32 underperforming stores signals a strategic pivot toward a more focused and efficient operation, while investments in store remodels, price competitiveness, and private label development aim to strengthen the chain’s appeal to contemporary consumers. Despite these challenges, Stop & Shop maintains significant strengths, including its extensive geographic presence, particularly in southern New England, and the resources and scale advantages that come with being part of global retail group Ahold Delhaize. The company’s community involvement initiatives and sustainability commitments also position it to connect with growing consumer interest in socially responsible business practices. As Stop & Shop moves forward, its success will likely depend on its ability to sharpen its competitive differentiation, strengthen connections with local communities and producers, and deliver a more distinctive and compelling shopping experience. While the path ahead contains both opportunities and obstacles, Stop & Shop’s long history of adaptation suggests the potential for continued evolution in response to changing market dynamics.

Resources for Consumers and Job Seekers

For Consumers

- Official website: https://stopandshop.com

- Store locator: https://stopandshop.com/store-locator

- Weekly ads/circulars: https://stopandshop.com/pages/weekly-circular

- Loyalty program information: https://stopandshop.com/pages/go-rewards

- Online shopping: https://stopandshop.com/shop

- Mobile app: Available on App Store and Google Play

- Customer service contact: 1-800-767-7772

- Social media profiles: Facebook, Twitter, Instagram (@stopandshop)

For Job Seekers

- Careers page: https://stopandshop.com/pages/careers

- Benefits information: https://stopandshop.com/pages/benefits

- Current job openings: https://stopandshop.com/pages/careers

- Employee testimonials: Available on the careers page

- Internship or training programs: Information available through the careers page

- Glassdoor profile: https://www.glassdoor.com/Overview/Working-at-Stop-and-Shop-EI_IE2945.11,24.htm

References (click to expand)

- Ahold Delhaize. (2025, February 12). Ahold Delhaize reports Q4 2024 financial results and introduces outlook for 2025 with projected growth in sales and earnings in line with its Growing Together strategic ambitions. https://newsroom.aholddelhaize.com/ahold-delhaize-reports-q4-2024-financial-results-and-introduces-outlook-for-2025-with-projected-growth-in-sales-and-earnings-in-line-with-its-growing-together-strategic-ambitions/

- Grocery Dive. (2025, February 13). Ahold Delhaize records positive comps and higher operating income in the US. https://www.grocerydive.com/news/ahold-delhaize-fourth-quarter-2024-earnings-grocery-stop-and-shop/740062/

- Grocery Dive. (2024, July 30). Can Stop & Shop win in the Northeast? https://www.grocerydive.com/news/ahold-delhaize-stop-and-shop-analysts-remodel-closure-supermarket-grocery/722564/

- ReportLinker. (2024, August 30). The Future of Grocery Retail: Stop & Shop’s Strategic Pivot Amidst Market Shifts. https://www.reportlinker.com/article/7727

- Stop & Shop. (2024). Social Responsibility Report. https://stopandshop.com/pages/stop-and-shop-social-responsibility

- Stop & Shop. (2024). Sustainability. https://stopandshop.com/pages/sustainability

- Progressive Grocer. (2024, April 17). Stop & Shop Shares Update on Its Work to ‘Feed It Forward’. https://progressivegrocer.com/stop-shop-shares-update-its-work-feed-it-forward

- Globe Newswire. (2024, April 18). Stop & Shop Releases First Corporate Social Responsibility Report. https://www.globenewswire.com/news-release/2024/04/18/2865462/0/en/Stop-Shop-Releases-First-Corporate-Social-Responsibility-Report.html

- Stop & Shop. (2024). Community. https://stopandshop.com/pages/feed-it-forward

- Stop & Shop. (2024). Stop & Shop Kicks Off Annual Register Campaign to Fight Student Hunger. https://stopandshop.com/pages/stop-and-shop-press-release-fight-student-hunger-2024

Leave A Comment